What to watch for lithium in 2025

Lithium auctions and a Chinese exchange with too much lithium

The metals that are most-watched would have standardized futures contracts from exchanges like the London Metal Exchange, COMEX and Shanghai Futures Exchange. Fundamentally, the futures market serves the purpose of price discovery. For example, this means:

all participants agree that today's price of copper in US is $4.34/pound and the agreed price of copper 6 months later is USD$4.40/pound, using COMEX as a benchmark.

The lithium market is at crossroads now. Big producers like Albermarle, SQM and Tianqi lithium have resorted to the traditional method of auctioning their products. This is despite LME and CME having launched lithium hydroxide futures. But there is a new exchange more attractive than LME and CME.

1) Where is the fair price benchmark?

An exchange in China is gaining attention for its lithium carbonate and silicon metal futures contracts. Guangzhou Futures Exchange (GFEX) has seen overwhelming volumes that its competitors strive to achieve. With a strong domestic market for EV battery consumption and production, the world is looking at GFEX for the fair price of lithium carbonates. Because LME and CME have launched lithium hydroxide futures instead of carbonates, GFEX is unique in its offering.

2) Where are "all participants"?

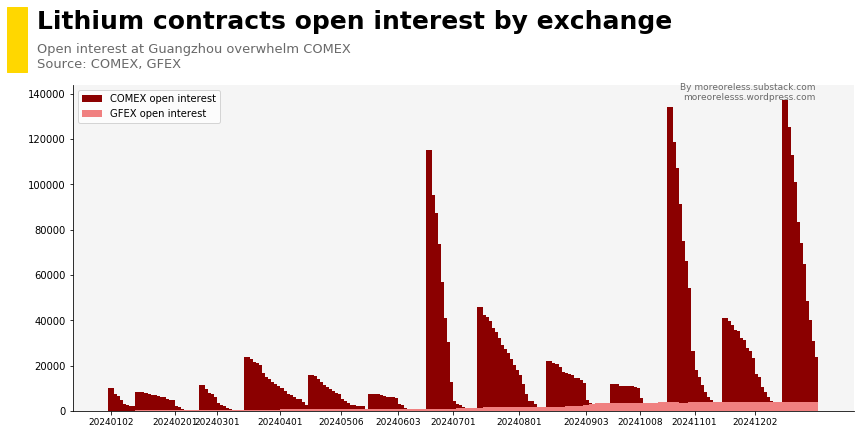

Volume / open interest is everything to an exchange because it reflects the size of "all participants". The bigger the crowd, the wiser the fair price. GFEX open interest for its lithium active contracts (contracts with the nearest month expiry) has exceeded that of COMEX's. Not pictured, but at this level, GFEX lithium has similar volumes and open interests against the LME copper contract, while catching up to the volumes of COMEX copper contract and LME aluminum contract.

3) Who are "all participants"?

Since the GFEX contract is a physically delivered one, we can expect battery manufacturers, lithium producers and consumers to be those with open positions. There will always be some speculators in the mix, but the physical aspect of this contract encourages price convergence between the derivative and physical asset. (The consequence of divergence: how copper futures have soared despite poor demand.) As participants have to deliver or close the position, and convergence is expected, producers and manufacturers can rely on the price to hedge their business activities. Again, another structure to ensure GFEX reflects the true price of lithium used commercially.

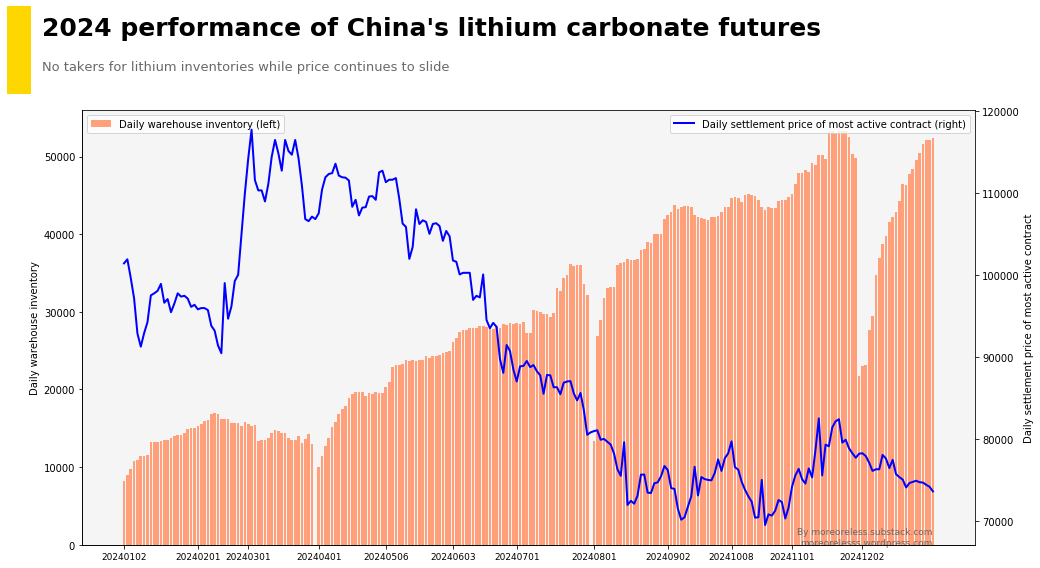

As of end 2024, GFEX reported a total of about 52,400 lots of futures warehouse receipts, equivalent to 52,400 tons of lithium carbonate (trading unit is 1 ton per lot). Assuming about 40kg of lithium carbonate is used to make 1 EV battery, 52,400 tons is about 47,536,480kg of carbonate, which can make about 1.1-1.2 million EVs. A price fall with an increase in inventory signifies that participants are, rightfully, using the exchange as the market of last resort.

4) What's next for lithium?

Mining deals like Rio-Arcadium and Zijin-Zangge have been announced but capacity cuts are unclear. If GFEX represents a fair opinion on market supply and demand, the crowd is signalling an oversupply in lithium. From economics 101, an oversupply can simply be corrected by boosting the demand from EV batteries or making production cuts.

Meanwhile, there is another contender for the lithium carbonates contract: Abaxx Exchange. Here is the CEO of Abaxx discussing their journey to launch physically deliverable futures contracts for nickel sulfate and lithium carbonate:

Outside China, there are currently no lithium carbonate futures contracts that are physically deliverable, said Sacha Lifschitz, director of metals markets at Abaxx, who formerly worked for trading houses Glencore and Concord Resources.

"All the other (lithium carbonate) contracts outside of China are cash-settled. So we see a clear demand and need," Lifschitz told Reuters.

Having another lithium carbonate contract outside of China can seem unnecessary, but the market dynamics have worked in the case of iron ore. There is a onshore iron ore contract at Dalian Commodities Exchange and another contract on the Singapore Exchange. Participants can have a variety of instruments (futures, options, swaps), currencies (CNY, USD) to cater for hedging or speculative needs. This model can potentially work for lithium carbonate, if Abaxx can gather sufficient volumes and interests. That's the first step to legitimising their prices for discovery.