In this week’s ore finds:

1) Iron ore grades are declining

The global benchmark CFR China iron ore spot lump premium assessment of Platts will be revised to 62% Fe iron ore lump, from the current 62.5%. Alumina and phosphorus will be adjusted higher to reflect higher impurities.

The lump premium of its IODEX iron ore fines benchmark will also be “assessed over a strip of 61%Fe iron ore fines and the outright lump assessment will reflect the 62% lump specification and 61% Fe fines basis.”

This will be a seismic shift for Singapore Exchange where most of iron ore futures, options and swaps are traded and priced against the Platts benchmarks. Personally, I think this will not be the last revision, given the declining ore quality.

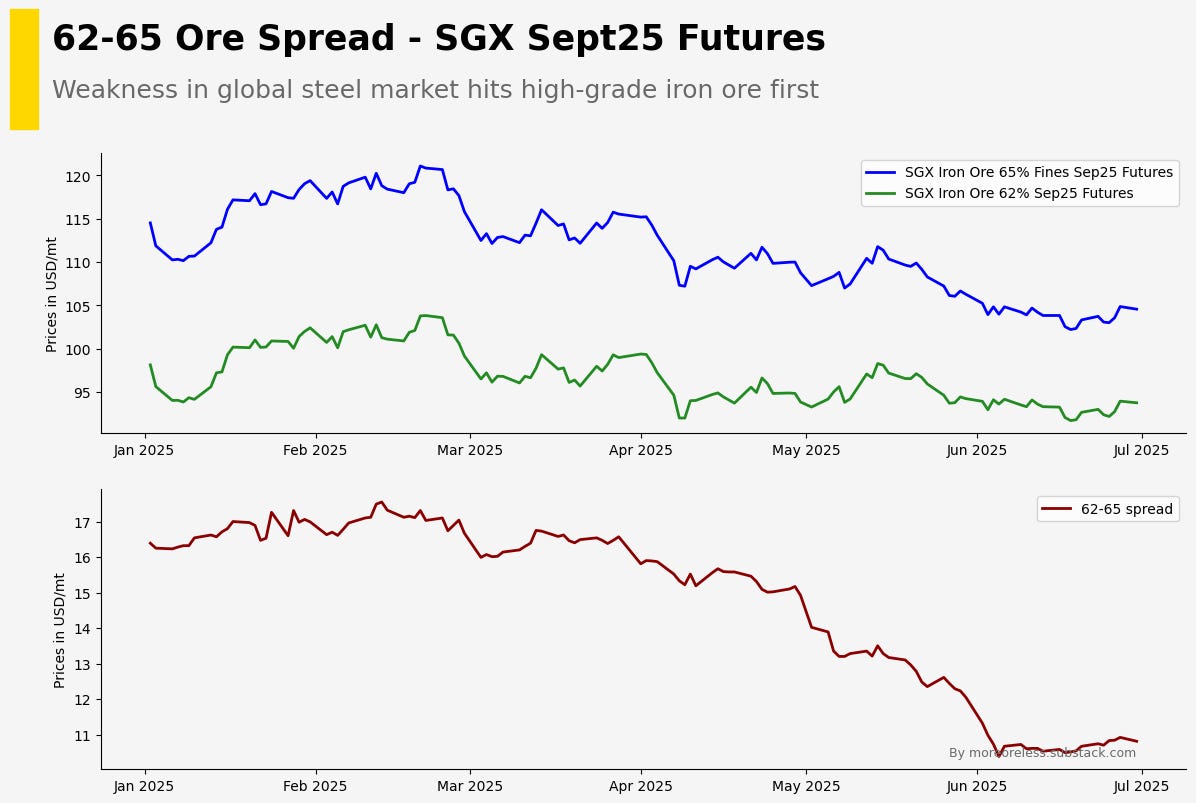

With fines and lumps quality in this region declining, the ore spread will be one to watch. It is the 65%-62% Fe differential based on the underlying SGX contracts and the growing gap in iron quality could drive the two markets apart.

Sometime in 2022, China's Dalian Commodity Exchange (DCE) lowered the iron quality of its flagship futures from 62% to 61%. The price movements between SGX and DCE contracts have historically closely track each other. Now, as they gradually head towards the same specifications, the price movements between the two is another spread worth tracking. Though, in reality, this arbitrage is rarely traded as DCE has limited international partipants, making it a largely domestic play.

2) Costly operations don’t stand a chance

In reality, iron ore cargoes vary in quality. Cargoes can range from 60% to 62% while using the same 62% benchmark for sale, because there is an adjustment based on dollar per percentage of iron.

If grades are declining, naturally revenues will fall as well. Unprofitable operations simply don't have a chance in this.

Reported from Argus:

Yilgarn Hub ran at a delivered cost of A$139/wmt ($91/wmt) in July-December 2023. Argus' iron ore fines 62pc Fe (ICX) cfr Qingdao was last assessed at $93.30/dry metric tonne (dmt) on 27 June.

MinRes has long cited costly operations at its Yilgarn Hub iron ore complex. In FY23, the company actually took steps to sell lump products from Yilgarn Hub, but high costs from increased haulage and labour could not abate the situation. In contrast, its Utah Point Hub operations is doing better overall despite the iron ore fines shipped from there.

Not every iron ore operation in Western Australia has it easy.